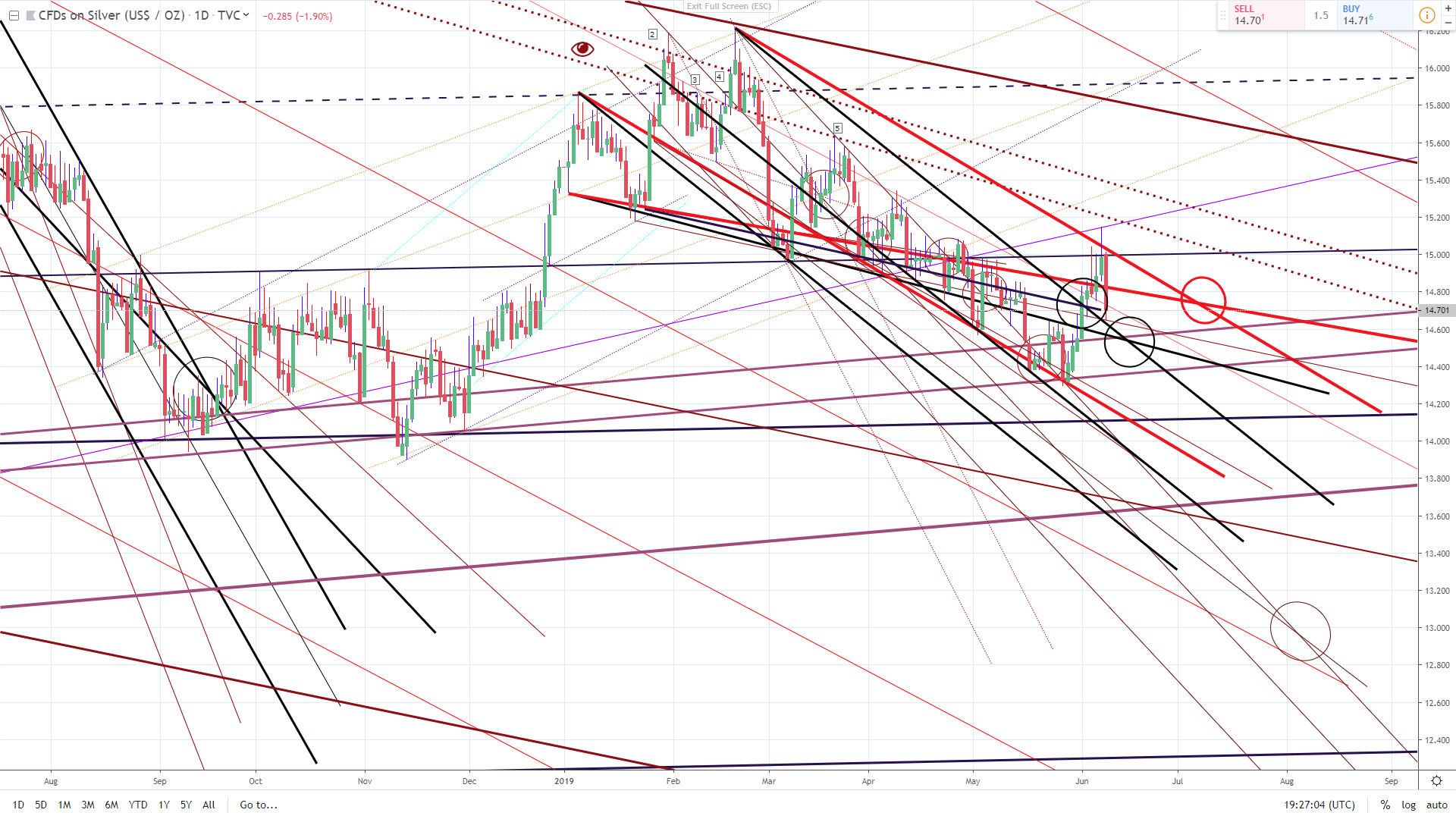

As indicated in my previous post, Silver passed through the 17.70USD price point on October 3.

View larger image here.

Predicting precise future price points accurately should be the Holy Grail of trading or investing. Common knowledge says that it’s simply impossible to do.

There are so many variables to take into account, right? There must be some serious higher-level mathematics going on to even attempt it, right?

Modeling Fall Channels and finding their EXITS using the Lines Of Force method requires only human eyes and a human brain. There is no algorithm. There is no higher-level math. To one who has learned the method, it’s almost easy.

Throughout literally hundreds of models–individual charts on dozens of securities–the Fall Channel EXIT has indicated precise price points in time with better than 99% accuracy. I believe anyone can learn how to do this. Ask me how.

NEVER TRADE YOUR MONEY BASED ON MY WORK OR ANY WORK OTHER THAN YOUR OWN. MY WORK LOOKS AT PRICE AND PRICE ACTION OVER TIME AND IS FOR ENTERTAINMENT PURPOSES ONLY.

NO TECHNICAL INDICATORS. NO FUNDAMENTAL ANALYSIS.

IT’S YOUR MONEY. PROTECT IT.